SYNOPSIS

A ten-step plan for finding peace, safety, and harmony with your money—no matter how big or small your goals and no matter how rocky the market might be—by the inspiring and savvy “Budgetnista.”Available for purchase on: Amazon // Target // Wal-Mart // Barnes & Noble // Books-a-Million

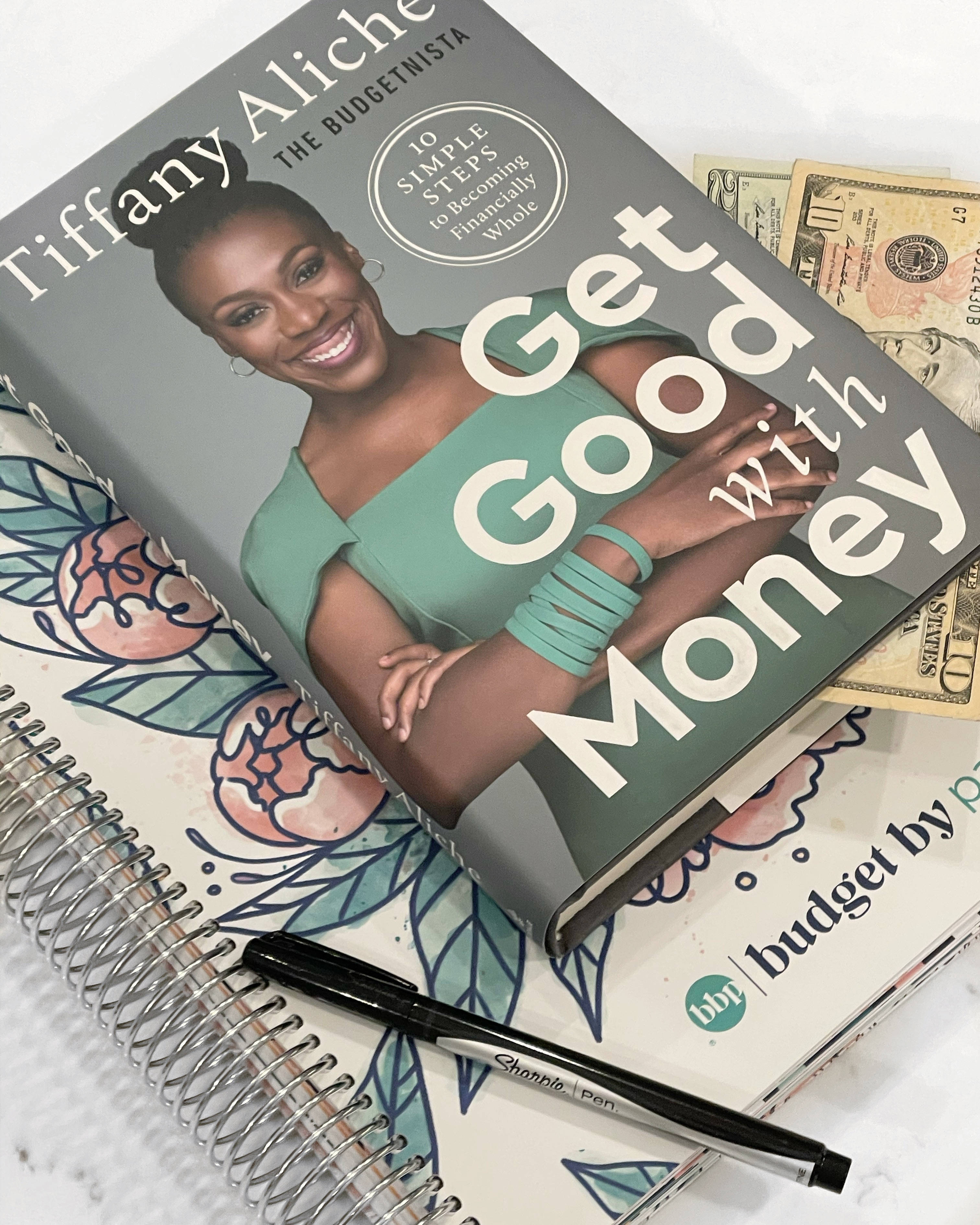

I kicked off my first read of the year with Get Good With Money by Tiffany Aliche (also known as “The Budgetnista.”) Before discovering this book in the aisles of Target last year, I wasn’t familiar with Tiffany or her reputation as a blogger and financial expert. After reading the book, I learned she has built a community on educating others about finance. She’s very active on social media and has a ton of useful resources on her websites. I'll link both of her sites TheBudgetnista.com and GetGoodWithMoney.com if you want to learn more.

As I’ve gotten older and started managing my own funds, learning about money has become exciting and empowering. I think it’s important to educate yourself not only to be knowledgeable on the topic, but also so you can make the right decisions when it comes to your own financial health. You have to take care of your current and future you! It's easy to avoid this because it can feel overwhelming or too difficult to understand. It definitely not fun having to face the music of reality either if you have a lot of debt or like to spend too much! Sometimes you just have to dive in and go! Everything will become a lot more manageable and less overwhelming once you do. For me, staying in the know has given a greater sense of direction with my money and tackling my goals.

If you don't know where to begin, Get Good With Money is a great place to start. The book outlines ten essential parts of becoming financially whole: Budgeting, Saving, Becoming Debt Free, High Credit Scores, Increasing Income, Investing, Having Insurance, Increasing Net Worth, Financial Experts + Estate Planning. Tiffany does a great job of explaining all of these concepts in great detail but in a way that's easy to understand. You'll learn the basics and financial keystones that a lot of financial experts preach. Think things like having an emergency fund, spending less than you earn, budgeting and so forth.

I found the most value in Get Good With Money in the chapters about investing, insurance and estate planning. One of my current goals is to learn and invest more of my money beyond saving for retirement. This is still relatively new for me so I enjoyed learning more about the specifics from Tiffany's perspective. She also gave me a lot of things to think about and consider when it comes to insurance and estate planning, especially going forward in life.

If you're looking to educate yourself on personal finance, Get Good With Money is a great place to start. It serves as a valuable tool with in-depth information on all of the basics and provides actionable steps to take control of your money.

What should I read next?

I love sharing book reviews with you all! Should you click on or make a purchase through the links in this post, I'll earn some money to keep on shopping! Pretty cool, huh? :)